- Home » News » World News

Industrial software sales will overtake hardware in 2022

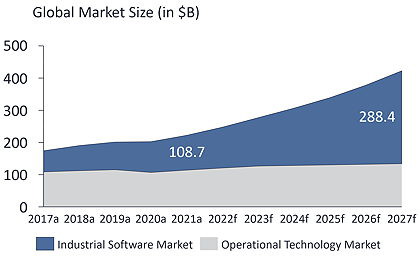

This year will be “a turning point” for industrial automation, with the average manufacturer spending more on industrial software than on automation hardware for the first time ever, according to new research by IoT Analytics. It says that just five years ago, the industrial software market was about 40% smaller than the hardware OT (operational technology) market, but manufacturing is increasingly becoming software-based and five years from now, the industrial software market will be twice the size of the hardware market.

According to the analyst, the software market was worth $109bn last year, but will expand at a CAGR of 18% over the coming five years to be worth an estimated $288bn by 2027.

The changes are also affecting the shape of the vendor market, with four of the five biggest suppliers of industrial software now coming from the general-purpose IT sector, rather than being automation specialists. The only traditional automation supplier in the top five is Siemens, in third position, with an estimated 5.3% of the industrial software market.

Last year, Microsoft overtook SAP to become the world’s largest vendor of industrial software, with 10.4% of the market, according to IoT Analytics. Microsoft, it says, has gained significant market share due to its “dedicated focus on, and value proposition for, manufacturers”, most notably through its Microsoft Dynamics and Azure products. The analyst adds that Microsoft is among the top five suppliers in six of the 14 industrial software categories that it analysed – namely, cloud infrastructure and services, cybersecurity, data and analytics, field service, IIoT platforms and virtualisation.

In a new report, Industrial Software Landscape 2022–2027, IoT Analytics identifies several key factors driving the adoption of industrial software, including:

• The digitisation of information flows and data Many previously unconnected assets are coming online, workers’ instructions are being digitised, and processes such as KPI measurement are being automated.

• Softwarisation/virtualisation of hardware Hardware budgets are becoming software budgets – for example, companies are spending their money on public cloud software instead of running their own servers on-site.

• Integration of systems and processes More APIs, interfaces and connectors are being built, tying in suppliers or customers.

• More capable and efficient software Software is starting to replace humans in certain tasks, or at least providing significant support. IoT Analytics compares the limited CAD tools of 20 years ago with the powerful capabilities of real-time 3D simulation and other tools today.

• Systems and data need more efficient protection As system complexity grows, cyber-threats are driving the need for more protection and detection.

• Manufacturers reacting to short-term changes and new requirements Market needs are changing, and transparency, flexibility, and the ability to react quickly, are becoming critical. Software can often offer this and allows manufacturers to monitor new KPIs, such as tracking CO2 emissions.

IoT Analytics reports that the industrial software market is relatively fragmented, with some segments exhibiting particularly high growth rates – such as cloud infrastructure and services, cybersecurity, and data analytics. As more companies digitise and modernise their software set-ups, vendors with a heavy involvement in these segments will gain a larger portion of industrial software budgets.

The growth rates of the top 10 industrial software suppliers vary widely. In five years’ time, the top 10 will almost certainly not be the same as today, the analyst predicts. Factors that will determine future success will include suppliers’ ability to:

• differentiate themselves in new edge-to-cloud set-ups;

• transition to SaaS (software as a service); and

• differentiate themselves with new capabilities, such as AI or low-code technologies.

IoT Analytics: Twitter LinkedIn Facebook