- Home » News » World News

UK robot density rises by 77% in 5 years, as the world doubles

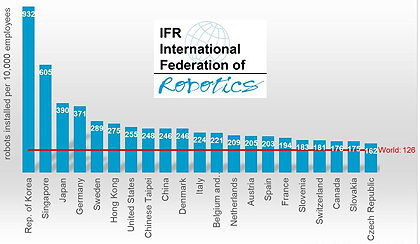

The UK’s industrial robot density – the number of installed robots per 10,000 manufacturing workers – climbed from 71 in 2015 to 101 in 2020, according to figures released by the International Federation of Robotics. Although this represents a growth rate of 77% over the five years, it is far behind the global average, which almost doubled from 66 to 126 over the same period. It puts the UK in 24th position in the global league of robot densities, behind countries including Slovenia, Slovakia and the Czech Republic.

According to the IFR, the exodus of foreign labour from the UK after Brexit increased the demand for robots during 2020, and it expects this situation to continue. The modernisation of the UK manufacturing industry will also be boosted by the availability of “super-deduction” tax incentives between April 2021 and March 2023, during which time UK companies can claim 130% of capital allowances as a tax relief for plant and machinery investments.

The global leader in robot density remains the Republic of Korea, which has held this position since 2010. Its robot density of 932 per 10,000 workers exceeds the global average seven-fold, and its robot density has been increasing by 10% on average every year since 2015.

The world’s second-highest robot density (605) can be found in Singapore, where densities have been growing by 27% on average every year since 2015. Japan is ranked third with 390 robots per 10,000 manufacturing workers in 2020. Japan’s robot-makers built 174,000 machines in 2020, representing 45% of the global total.

In China, the robot density rate rose from 49 in 2015 to 246 in 2020, placing it in ninth position globally. Five years ago, it was 25th.

Europe’s most automated country, Germany, ranks fourth globally with 371 robots per 10,000 workers. It accounted for a third of the industrial robots sold in Europe during 2020. An estimated 38% of Europe’s operational robots are in Germany. The German robotics industry is recovering, driven mainly by strong overseas demand rather than by the domestic or European markets. The IFR expects robot demand in Germany to grow slowly, mainly supported by demand for low-cost robots in the general industries and outside of traditional manufacturing.

Sweden has Europe’s second-highest robot density (289), followed by Denmark (246), Italy (224), Belgium (221), the Netherlands (209), Austria (205), Spain (203) and France (194).

Robot densities in the US rose from 176 in 2015 to 255 in 2020, putting it in seventh position globally. The modernisation of domestic production has boosted robot sales in the US. Several automotive manufacturers are investing in their factories to produce electric cars or to boost battery production. These major projects are expected to create more demand for industrial robots over the next few years.

“Robot density is the barometer to track the degree of automation adoption in the manufacturing industry around the world,” says IFR president, Milton Guerry.