UK manufacturing output rises for fourth month in a row

The UK manufacturing sector continued its recovery from the Coronavirus-induced downturn during September. Output and new orders increased as new work intakes improved from both domestic and overseas markets, according to the latest seasonally adjusted IHS Markit/CIPS Purchasing Managers’ Index (PMI).

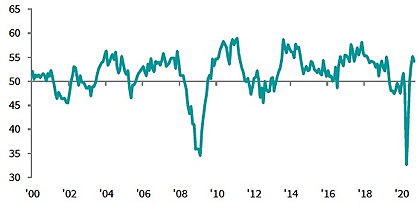

The PMI fell slightly to 54.1 in September, down from August's 2½-year high of 55.2. The index has stayed above its no-change mark of 50 for four successive months – its longest sequence of expansion since early 2019.

Output increased for the fourth consecutive month, despite the rate of growth easing slightly. Higher production was linked to improved inflows of new work, companies reopening and staff returning to work. Large manufacturers saw the fastest growth and small firms the slowest.

Underpinning the recovery in output was a further increase in new orders. New business rose for the third month in a row, reflecting a combination of improving customer demand, rising export orders, signs of recovery in the retail sector, and the reopening of schools.

Emergence from lockdowns and changes to Covid-19 restrictions boosted the export performance of the UK manufacturing sector in September. New export business rose for the second month, with the rate of expansion reaching a 21-month high. The increase was linked to stronger demand from Europe, Asia and North America.

Employment continued to fall for the eighth consecutive month, although the rate of reduction eased to its lowest since February. Some firms implemented redundancy programmes, while falling work-in-hand signalled that sufficient capacity remained to cope with the needs of existing and new contracts.

Manufacturers are maintaining a positive outlook for the year ahead, with 60% expecting output to be higher 12 months from now. The degree of confidence was close to July's 28-month high. However, more firms were uncertain about the path ahead, especially regarding Covid-19 and Brexit.

“September saw UK manufacturing continue its recovery from the steep Covid-19-induced downturn,” says Rob Dobson, director at IHS Markit, which compiles the survey. “Although rates of expansion in output and new orders lost some of the bounce experienced in August, they remained solid and above the survey's long-run averages.

“Export demand is also picking up, as economies across the world restart operations and adjust to Covid-19 restrictions,” he adds. “Business sentiment remained positive as a result, with three-fifths of UK manufacturers forecasting a rise in output over the coming year.

“While the sector is still making positive strides, keep in mind that there remain considerable challenges ahead,” Dobson cautions. “This is especially true for the labour market, which saw further job losses and redundancies in September. The full economic cost incurred by 2020 will likely rise further as governments look to re-introduce some restrictions, job support schemes are tapered and rising numbers of firms start focussing on Brexit as a further cause of uncertainty and disruption during the remainder of the year.”

“Manufacturing made solid progress towards recovery in September, with just a minor step back from August’s two-and-a-half-year index high,” adds CIPS group director, Duncan Brock. “New pipelines of work increased for the third month in a row and export orders the strongest for almost two years.

“The impetus behind this resurgence, lies in the release of delayed projects and more people returning to work but the employment picture overall darkened significantly,” Brock continues. “Some firms continued to make use of the furlough scheme to retain their workforce, but larger numbers of redundancies this month means we have a wretched end to the third quarter as job numbers fell for the eighth month in a row.

“This, in turn, placed a strain on production capacity further down the supply chain,” he reports. “Longer delivery times and increased competition for raw materials, caused the highest rate of input price inflation since December 2018. The increase in prices to customers followed closely behind and is set to continue for the remainder of the year.

“In spite of these difficulties, the sector’s glass remained half-full, and optimism for the year ahead was sustained,” Brock concludes. “Some businesses were using forward buying strategies to build stocks for Christmas and Brexit, which may boost employment levels, but it is anyone’s guess whether more lockdown disruptions derail this hope.”

• Commenting on the PMI report, Make UK economist Fhaheen Khan warns of possible trouble ahead: “Manufacturers are continuing to benefit from the easing of restrictions and the return of some staff from furlough. As expected, an increase in orders from East Asia is the primary source of revenue for businesses whilst other key markets still remain at least partially closed. However, there is clearly a slowdown in the rate of expansion, indicating the quick recovery was a result of pent-up demand, which is now beginning to fade.

“As this demand peters out,” Khan adds, “with little sign of orders returning and job losses rising even before the job retention scheme expires this month, the uphill struggle for manufacturers starts now. We must forge a long-term plan for recovery starting with a revitalised industrial strategy that places manufacturing on the forefront and provides extra support to those key strategic industries that are still vulnerable.”