- Home » News » World News

Industrial Ethernet powers ahead, while fieldbuses slide

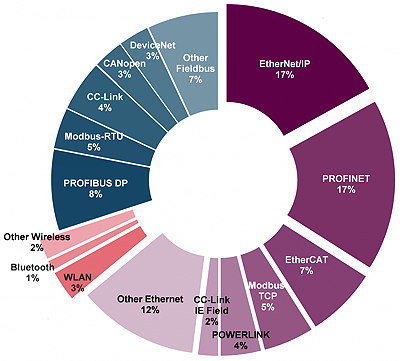

Industrial Ethernet increased its share of the global market for new industrial networking nodes from 59% in 2018 to 64% last year, while fieldbuses continued to decline, dropping from 35% in 2018 to 30% in 2019. The figures come from the latest annual analysis of the industrial networking market by the Swedish industrial networking specialist, HMS Networks.

Among the various versions of industrial Ethernet, Profinet and EtherNet/IP are joint market-leaders, each holding 17% of the market. EtherCat is next on 7%, followed by Modbus-TCP on 5%, overtaking Ethernet Powerlink on 4%.

Among the fieldbus contenders, Profibus is still in pole position with 8% of the market – but this was the first time that it had dropped below 10% of the industrial networking market. Runners-up were Modbus-RTU on 5%, followed by CC-Link on 4%.

In 2019, wireless technologies accounted for 6% of the global market, with WLANs (wireless local area networks) still being the most popular technology, followed by Bluetooth.

“Wireless keeps its market share of a growing market, which is not bad, but we expect the wireless share to increase over time,” says HMS’ chief marketing officer, Anders Hansson. “With all ongoing activities globally about wireless cellular technologies – for example, private LTE/5G networks – as enablers for next-level smart manufacturing, market demand will increase for wirelessly connected devices and machines to be included in the less cabled and flexible automation architectures of the future”.

HMS says that its position as an independent supplier of industrial communications and IIoT technologies gives it a “substantial insight” into the industrial networking market. In its annual analysis, it estimates market shares for fieldbuses, industrial Ethernet, and wireless. For the first time, HMS has not included estimated growth rates for this year, because of the Coronavirus pandemic.

“We expect the industrial network market to grow steadily during the coming years but, due to the unique Coronavirus situation which is now affecting the general business conditions globally, we have chosen not to include growth numbers in our 2020 analysis – only market shares”, says Hansson.

“So, only focusing on market shares this year, we see that Industrial Ethernet continues to drive industrial connectivity in factories, headed by EtherNet/IP and Profinet, with EtherCat in third place,” Hansson continues. “Profibus is still the biggest fieldbus but has lost market share as the general decline for fieldbuses continues.

“Another interesting finding is that Modbus keeps doing well – both when it comes to fieldbus Modbus RTU, as well as the Ethernet-based Modbus TCP – indicating that factories do not refrain from using well-working technologies in their new installations just because they have been around for some time.”

In Europe and the Middle East, EtherNet/IP and Profinet are the market-leading technologies, with Profibus and EtherCat as runners-up. Other popular networks are Modbus (RTU/TCP) and Ethernet Powerlink.

The US market is dominated by EtherNet/IP, with EtherCat gaining market share. A fragmented Asian market is led by Profinet and EtherNet/IP, followed by Profibus, EtherCat, Modbus (RTU/TCP) and CC-Link/CC-Link IE Field.

The HMS study is based on the company’s estimation of number of new nodes installed for factory automation duties in 2019. It defines a node as a machine or device connected to an industrial network. The figures represent HMS’ view, based on its own sales statistics, insights from colleagues in the industry, and an “overall perception of the market”.