Brexit could hit the UK’s $30bn machinery market

The impact of the UK’s exit from the European Union on the country’s $30bn machinery production market will depend largely on whether it makes a “soft” or a “contentious” exit from the EU, according to a new analysis from IHS Markit.

This year, more than 37% of the UK’s machinery exports will go to the EU. Thus almost any EU response to Brexit will affect machinery production and the UK’s machinery exports adversely.

Even before Brexit, IHS Markit was predicting that the UK’s machinery production sector would contract by 1.6% during 2016, before reviving to deliver an average growth of 3% in the period to 2020. The sector had been in decline, falling 11.2% year-on-year, mainly as a result of its exposure to commodity exporters in South America and elsewhere.

The analyst forecasts that Brexit will reduce global GDP growth in 2017, with the UK being the hardest hit, followed by Europe (including Spain, Germany, France and Poland) – and even economies as far away as Singapore and Brazil.

In a “contentious” exit, the EU would seek to make trade rules and regulations that would result in fewer machinery imports from the UK. It could even re-route entire supply chains out of the UK. In this scenario, the EU would strictly enforce the Common Customs Tariff that applies to goods crossing its external borders.

Currently, says IHS Markit, EU importers are committed to existing manufacturing sites in the UK, and many have said there no immediate changes are needed. However, others have stated that supply conditions will have to be renegotiated.

A “soft” exit would require renegotiating of terms of trade, which could result in some trade friction, but would be on amicable terms. A tariff-free trade pact with the EU could, in fact, benefit some manufacturers in the UK and provide long-term potential benefits, suggests IHS Markit senior data analyst, Rolando Campos.

He points out that David Davis’s appointment as Minister for Brexit makes a complete exit more likely, “with all the risks that process entails”. Davis is unlikely to settle for a half-Brexit political compromise, and has resigned from government on principle before.

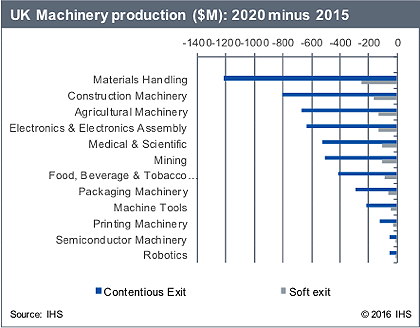

IHS Markit has modelled three scenarios – pre-Brexit, a soft exit and a contentious exit – and looked at their long-term impact by industry. The results are shown in the graphs. In the short term, the weaker British pound will improve competitiveness, but towards the end of the forecast period, the effects of EU tariffs, loss of customers in Europe, and weaker UK labour markets will start to have an effect.

While the UK has a balanced mix of machinery industries, compared to other countries, its machinery exports are more concentrated by industry and especially by export region (specifically the EU).

Machinery exports, under SIC definitions, provide several segments that indicate where equipment is exported. For example, materials-handling and packaging machinery are a subset of the general industrial-export segment, while construction and mining machinery is a subset of mining and construction. The “special industry” SIC is a catch-all for things such as robotics, medical and scientific, and plastic and rubber machinery.

In absolute terms, the materials-handling, packaging machinery, and mining and construction machinery segments are most at risk from Brexit. Agricultural, heating and cooling, and the machine tools segments would be the most sensitive to any changes in EU demand, with 45–62% of global exports in this sector going to the EU.

According to Campos, Brexit presents an opportunity for UK machinery equipment manufacturers, giving them more flexibility to enter trade agreements on the UK’s own terms and to benefit from a weaker currency. He predicts that the British pound (GBP) will depreciate against the US dollar – bottoming out at $1.20 per GBP in 2016, before rising to nearly $1.50 by 2019 – as well as against the Euro, which will make exports more competitive from 2016 to 2019.

There are risks to Brexit, however, that may outweigh any benefits, Campos adds. In the UK, skill migration will become more difficult, and it will become more expensive to attract skilled workers needed for the factories of the future. Labour mobility is more likely to be a slow drag on growth over the next decade, but it is an important one to monitor, says IHS.

The more pressing issue is that regulations and trade rules will have to be renegotiated, and this may be the most difficult hurdle to overcome, depending on whether the UK makes a contentious or soft exit from the EU.