- Home » News » World News

Fieldbus market is still twice as big as industrial Ethernet

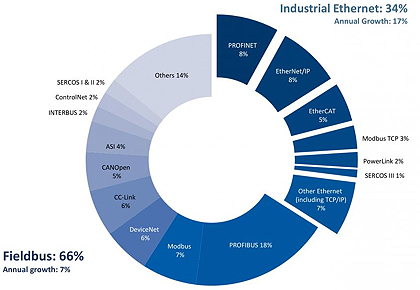

Fieldbuses still account for two-thirds (66%) of new industrial communications nodes, with various versions of industrial Ethernet making up the remaining third (34%), according to figures released by the Swedish industrial communications specialist, HMS Industrial Networks.

Using figures drawn from its own sales, contacts in the industry, and its perception of the market, HMS estimates that the number fieldbus nodes being installed globally, is still expanding by around 7% a year, although industrial Ethernet is growing more than twice as fast (17%). Even so, “it will take some time before industrial Ethernet outgrows fieldbuses,” HMS suggests.

In terms of individual networking technologies, Profibus remains the most widely used around the world, with around 18% of global sales of all industrial networking nodes, including Ethernet systems. The next closest are two versions of industrial Ethernet, Profinet and EtherNet/IP, which are neck-and-neck, each accounting for about 8% of the total networking market. HMS sees no sign of consolidation in the industrial Ethernet market.

The company reckons that Modbus has 7% of the total industrial networking market, followed by DeviceNet and CC-Link, both on 6%, and EtherCat and CANopen, both on 5%. Smaller stakes are held by ASi (4%), Modbus TCP (3%), Ethernet Powerlink, Controlnet, Sercos I and II, and Interbus (all on 2%), and Sercos III (1%).

“With more than 25 years of experience in industrial communication, we have a very good insight in the industrial network market,” says HMS’ marketing director, Anders Hansson. “We see a shift towards industrial Ethernet but the migration to industrial Ethernet is taking longer than first expected. We still get a lot of requests for connectivity to both fieldbus and industrial Ethernet.

“What is completely evident, however, is that the network market remains fragmented and that industrial devices are getting more and more connected,” he adds. “This is accentuated by trends such as Industrial Internet of Things and Industry 4.0.”

According to HMS, the main drivers behind the continuing growth in demand for fieldbus are simplicity, reliability and tradition. The main drivers behind the growth of Ethernet are its higher performance and ability to integrate with office networks.

In the EMEA region (Europe and the Middle East), Profibus remains the dominant network, while Profinet is the fastest growing. The runners-up are Modbus and EtherCat.

The US market is dominated by the CIP family of networks, with EtherNet/IP overtaking DeviceNet in terms of market shares. Runners-up are Profibus and EtherCat. Profinet is gaining market share in North America, while Modbus remains popular.

In Asia, no single network stands out as the market-leader, according to HMS, but Profibus, DeviceNet and Modbus are all used widely. CC-Link dominates in Japan, while EtherCat is also gaining traction there.

HMS has recently shipped its three millionth Anybus module – its interchangeable communication modules that support a variety of fieldbus and industrial Ethernet networks. The modules offer connections for most of the main networking systems