Have we turned the corner?

Signs are emerging of a gradual improvement in machinery production and in the automation and motion engineering sectors in Europe. In this exclusive article, the economist Alan Beaulieu, CEO of ITR Economics and chief forecaster for the European Power Transmission Distributors Association, looks at what the future holds.

As we projected, things are looking up for Europe. German business confidence is improving, as is consumer confidence in Italy. Both are welcome inputs into our forecast of mild recovery among the EU-27 nations through the rest of this year and into 2014. Recent news of a drop in unemployment numbers in Germany is very encouraging for Europe’s largest economy and, by extension, for the rest of Europe.

The quarterly industrial production figures have been improving since January, and our analysis of external indicators suggests that more improvement is on the way. The rising trend in the European Leading Indicator is corroborating our forecast for Europe. You should plan for an increase in activity during the second half of this year.

Areas of global and regional economic weakness will persist, but we expect production in France and Germany to end 2013 slightly above their levels for 2012, while Spain and Italy will finish the year below their 2012 levels of activity. Ongoing expansion in the US, Latin America, and Africa will provide exporters with more opportunities as we move through the rest of this year.

In an effort to sustain momentum, the European Central Bank (ECB) cut two of its primary interest rates in early May to further encourage businesses and consumers to borrow capital. Policy-makers reduced the marginal lending rate by 50 basis points to 1.0% and the refinancing rate by 25 basis points to 0.5%. The difficulty comes in that businesses borrow based on confidence in the future, not just on low rates.

The rate reduction was widely expected and will not fuel a dramatic recovery, but it may encourage some positive activity in the business-to-business sector.

If you need to borrow, our advice is to have confidence based on current activity and leading indicators, and go out and borrow at exceptionally low interest rates. If you are using Euros, you will be paying these loans back with an inflated currency, which is an economic long-term win for anyone who participates. Make investments in your businesses that will drive efficiencies.

Housing prices in England and Wales rose to their highest level on record in May, and new construction in the private housing sector also rose. We project that UK industrial production will begin to rise late this year and into the first half of 2014, but the improvement will be very mild.

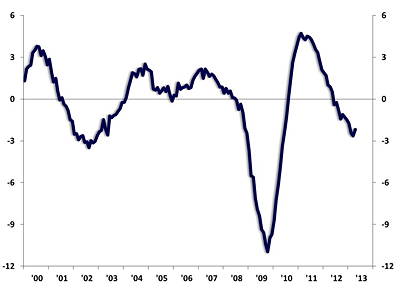

As ITR's UK Manufacturing Production Index (above) shows, after a long period of decline, year-on-year growth in UK manufacturing could finally be heading in the right direction again.

Activity in the drives and controls industry remains mixed within the UK and European markets. Annual European machinery production is down 1.9%, and we expect it to remain below year-ago levels into the second half of this year. Machinery production in the UK has fallen slightly less, and is currently 0.7% below 2012 levels.

European material-handling equipment production during the 12 months ending in March was marginally ahead of the previous year (by just 0.6%). While we expect annual production will move lower in the near term, we are projecting that the weakness is transitory and that an improving general economic climate will produce more activity in the material-handling equipment market.

European pump and compressor production – a subsector of the material-handling equipment industry – was 1.6% higher during the past three months than during the same three months last year, suggesting a recovery is taking hold in this sector.

Annual Europe motor vehicle production is 3.4% below last year’s levels, but there are tentative indications that activity is beginning to pick up in this sector. Motor vehicle production in the UK is seeing a mild rise, and is currently 1.6% above its 2012 level. Export activity and some improvement in domestic demand will result in a recovery in this important sector of industry, and increased activity in the drives and controls industry should follow.